A year of opportunity in Mexico

Eugene Ramirez | January 2020

With a 1.1% projected GDP growth, a Global Health Intelligence (GHI) report indicates there could be new opportunities in Mexico this year for the medical device industry. This follows the country’s mild recession in 2019. The key to success, according to GHI, is being analytical.

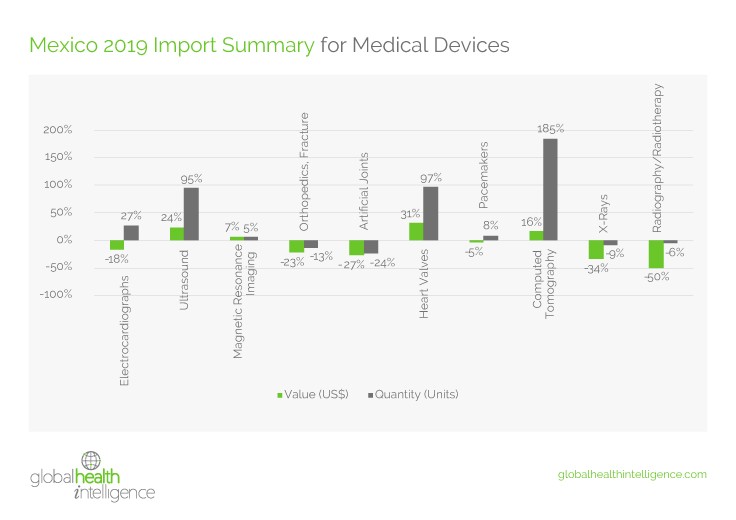

With few products manufactured in Mexico, the report draws data from import figures to analyze market activity. Despite the overall downturn in what some refer to as Latin America’s “lost half decade”, some medical device categories saw growth, including heart valves (97%), ultrasound machines (95%), and pacemakers (8%). The real standout was a 185% increase in imports of CT machines and parts.

From 2014 to 2019, Mexico’s medical device market saw a 12% increase in quantity, though it only represented a 2% increase in value. According to the report, the smaller margins are reflective of the Mexican president’s policies which allow more foreign competition.

With these mixed results, GHI is making a case for an analytical approach to new opportunities in Mexico, beyond growing existing business. The research firm recommends, among other tactics, leveraging market trends, independent market share tracking, integrating data from multiple sources into your CRM, and determining demand outside of your client base.

About Global Health Intelligence (GHI)

Global Health Intelligence (GHI) gathers market intelligence and performs market research to deliver clients strategic data on healthcare infrastructure in emerging markets, specifically in Latin America and Asia. GHI is partnering with FIME to offer more value to FIME exhibitors and attendees as we work together to share insights and keep our extended FIME family in a leading position in the medical device industry.